Unveiling the Hidden Tax Traps in Your 401(k) and IRA: Strategies for Escaping the Maze

Preparing for a comfortable retirement involves making wise financial decisions, and utilizing retirement savings accounts such as 401(k)s and IRAs is a crucial step. However, it's imperative to be aware of potential tax implications associated with these accounts to avoid unpleasant surprises down the road.

The Allure of Tax-Deferred Accumulation: A Double-Edged Sword

One of the primary benefits of 401(k)s and IRAs is the ability to contribute pre-tax dollars, allowing individuals to reduce their current taxable income. This tax-deferred growth provides the potential for more significant investment earnings over time.

4.2 out of 5

| Language | : | English |

| File size | : | 8025 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 98 pages |

| Lending | : | Enabled |

However, the tax-deferred nature of these accounts comes with a caveat: withdrawals in retirement are taxed as ordinary income, which can result in a substantial tax bill if not planned for adequately.

Tax Traps to Watch Out For

To effectively manage your retirement savings, it's essential to be aware of several potential tax traps:

- Required Minimum Distributions (RMDs): Once you reach age 72, you are required to take annual RMDs from your 401(k) and IRA accounts. Failure to withdraw the required amount can trigger a 50% penalty tax on the undistributed balance.

- Early Withdrawals: If you need to access funds from your 401(k) or IRA before reaching age 59½, you may face a 10% early withdrawal penalty in addition to paying ordinary income taxes on the withdrawn amount.

- Taxable Conversions: Converting a traditional 401(k) or IRA to a Roth account can provide tax benefits in the long run, but it's important to note that the conversion is a taxable event. The taxes must be paid at the time of the conversion.

- Inherited IRAs: When you inherit an IRA, you must take annual RMDs based on your life expectancy. If you are under age 59½, you may also be subject to the 10% early withdrawal penalty if you take distributions.

Crafting an Escape Plan: Strategies for Minimizing Tax Impact

While tax traps are a reality of retirement savings, proactive planning can help mitigate their financial impact:

- Contribute to Roth Accounts: Consider contributing to Roth 401(k)s or Roth IRAs, which offer tax-free growth and tax-free withdrawals in retirement.

- Plan for RMDs: Estimate your future tax bracket and consider converting some of your traditional 401(k) or IRA assets to a Roth account before RMDs begin to minimize the tax impact.

- Utilize Backdoor Roth Conversions: If you earn too much to contribute directly to a Roth IRA, consider using the backdoor Roth conversion strategy to convert after-tax 401(k) contributions to a Roth IRA tax-free.

- Diversify Your Retirement Income: To reduce reliance on taxable 401(k) or IRA withdrawals, explore other sources of retirement income, such as annuities, rental properties, or investments outside of tax-advantaged accounts.

- Seek Professional Advice: Engage the services of a qualified financial advisor who can provide personalized guidance and help you navigate the complexities of tax planning for retirement.

Tax traps are an inherent part of retirement savings, but understanding their implications and implementing proactive strategies can help you navigate them effectively. By leveraging the power of Roth accounts, planning for RMDs, diversifying your retirement income, and seeking professional advice, you can minimize the tax impact and secure a financially secure future.

Remember, retirement planning is an ongoing process, and regular reviews and adjustments may be necessary to adapt to changing tax laws, financial circumstances, and personal goals.

4.2 out of 5

| Language | : | English |

| File size | : | 8025 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 98 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Miriam Minger

Miriam Minger Eileen Depka

Eileen Depka Clemens Sedmak

Clemens Sedmak Helen Bently

Helen Bently G P R James

G P R James Jonathan Bartlett

Jonathan Bartlett Shelly Shaffer

Shelly Shaffer Donna W Reamy

Donna W Reamy Nick Cook

Nick Cook Mona Delahooke

Mona Delahooke Chris Mcgreal

Chris Mcgreal Gennaro Carrano

Gennaro Carrano Sue Kim

Sue Kim Liliuokalani

Liliuokalani Marshall Coleman

Marshall Coleman Don Foxe

Don Foxe Vickie Li

Vickie Li T L Payne

T L Payne Thomas R Harvey

Thomas R Harvey Edward C Nolan

Edward C Nolan

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Gene PowellThe Motor Boat Boys on the St. Lawrence: An Exciting Adventure Tale for Young...

Gene PowellThe Motor Boat Boys on the St. Lawrence: An Exciting Adventure Tale for Young...

Alexander BlairSpider-Man 2024: A Comprehensive Exploration of the Upcoming Superhero Film

Alexander BlairSpider-Man 2024: A Comprehensive Exploration of the Upcoming Superhero Film

Arthur Conan DoyleGivin It Their All: Uncovering the Extraordinary Stories of Everyday Heroes

Arthur Conan DoyleGivin It Their All: Uncovering the Extraordinary Stories of Everyday Heroes Angelo WardFollow ·2.8k

Angelo WardFollow ·2.8k Robert BrowningFollow ·11.7k

Robert BrowningFollow ·11.7k Herman MitchellFollow ·18.6k

Herman MitchellFollow ·18.6k Bryce FosterFollow ·16.2k

Bryce FosterFollow ·16.2k Frank ButlerFollow ·19k

Frank ButlerFollow ·19k Ian McEwanFollow ·13.4k

Ian McEwanFollow ·13.4k Eugene ScottFollow ·19.9k

Eugene ScottFollow ·19.9k Vincent MitchellFollow ·10.5k

Vincent MitchellFollow ·10.5k

Nick Turner

Nick TurnerBeethoven's Early Chamber Music: A Listening Guide

Ludwig van Beethoven's early...

Clarence Mitchell

Clarence MitchellJam Yahtzee Croshaw: The Enigma Behind the Beloved Board...

In the realm of board games, where dice roll...

F. Scott Fitzgerald

F. Scott FitzgeraldTeacher Research on Language and Literacy: Practitioner...

In an ever-evolving educational landscape,...

Alec Hayes

Alec HayesThe New Leadership Challenge: Creating the Future of...

The nursing profession is facing a number of...

Felix Hayes

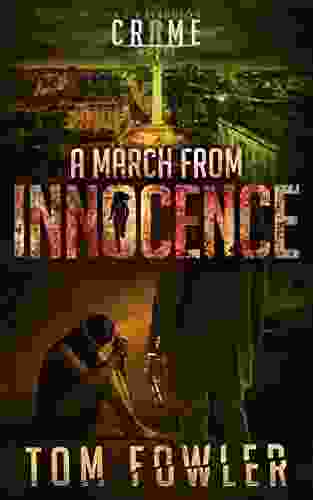

Felix HayesPrepare for Intrigue and Suspense: A Comprehensive Dive...

Step into the captivating world...

4.2 out of 5

| Language | : | English |

| File size | : | 8025 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 98 pages |

| Lending | : | Enabled |